Ord Minnett Research

Deutsche Bank

Westpac Alert – Legal and remediation costs to impact FY18 result – Ticker: WBC.AX, Closing Price: 27.81 AUD, Target Price: 31.00 AUD, Recommendation: Buy.

$235(¥25,850)m profit impact on FY18 from refunds and litigation provisions – After the market close today, WBC announced it expects an impact of $235(¥25,850)m (post-tax) on its FY18 result due to customer refunds as well as provisions for recent litigation. The remediation costs relate to the financial advice business and were not unexpected, given recent revelations at the royal commission. We anticipate customer remediation costs won’t be a confined issue, and is likely to impact peers as well given that multiple case studies at the royal commission highlighted problems across the advice sector such as ‘fees for no service’ and inappropriate advice. More broadly, this is likely a harbinger of further legal and remediation costs for the banks in the near term post the royal commission. We have reduced our FY18 NPAT forecast by 2.7% as a result of today’s disclosure.

Viva Energy Group Alert – Some welcome good news from Geelong – Ticker: VEA.AX, Closing Price: 2.29 AUD, Target Price: 2.65 AUD, Recommendation: Buy.

August was a good month for the refinery given the unplanned outage – We don’t want to get into the habit of focusing too heavily on month-by-month refinery margins but the August Refinery performance was much better than we feared given the unplanned outage. Throughput was relatively strong, suggesting the Refinery was performing very well prior to the outage and the margin was high. This is a pleasing outcome given our concerns margins could have been impacted by the progressive restoration of the refinery. There is still downside risk to 2H Prospectus Refinery earnings given the outage and weak Sing margins in July but the current throughput and margin premium run-rates are ahead of our below-prospectus forecasts.

Syrah Resources – Balama ramp up risks continue – Ticker: SYR.AX, Closing Price: 2.35 AUD, Target Price: 2.70 AUD, Recommendation: Hold.

Production downgrade we expected but from an issue SYR should have anticipated – SYR had advised the market that September production at Balama has been impacted by the delay in sourcing and fitting filter cloths (a routine consumable) and it now expects to produce 15kt vs. previously guided 18kt. It has guided the market to a Sept Q production forecast of 39-40kt which is in line with our expectations of 39.6kt. The delay doesn’t impact our valuation however highlights the continuing risk of ramp up at the Balama operation. We expect Balama to miss its full year guidance of 135-145kt, producing 128kt. This is still some way off a nameplate run rate of 350ktpa (CY19 guidance 250-300kt) and so there remains the risk of delays to the ramp up and commissioning (DBe 270kt in CY19).

Gold Industry – Denver Gold Forum – sector waiting for a spark, merger provides optimism – Barrick-Randgold deal and potential for further news flow the main talking point – We attended the Denver Gold Forum along with a mix of companies, sell-side and buy-side participants (over 1,200 participants overall). In general, sentiment for the sector has been weak with a lack of conviction on the gold price and also companies are largely without stock specific catalysts. However, the Barrick announcement could be the start of some improved interest with likely asset sales to follow from the deal and potential for other companies to consolidate in our view which would be good for the sector. We see room for greater efficiencies in the sector through combining businesses and rationalizing weaker assets. We are generally neutral-to-slightly negative on the direction of the gold price based on the current macro conditions; however, a change in equity market sentiment, geopolitical conditions or a slowdown in global growth could all signal a turning point with potential greater interest in gold equities for diversification/value vs other sectors. We have a Buy on Newcrest for ASX100 golds (large long life assets with production growth over the next two years) and a Buy on Dacian (developer ramping up Mt Morgans asset with exploration upside) for the juniors.

Treasury Wine Estates Alert – ACCC to investigate the wine grape industry – Ticker: TWE.AX, Closing Price: 17.62 AUD, Target Price: 18.00 AUD, Recommendation: Hold.

ACCC to conduct a market study of the wine grape industry – The ACCC has announced a market study of the Australian wine grape industry. The purpose is to complete an in-depth review of the industry and identify any market failures or trade practices issues that may be preventing the functioning of competitive markets, adversely affecting grape growers. Draft findings are expected in Mar 19, with a final report expected in June 19.

Whitehaven Coal – Company engagement – Ticker: WHC.AX, Closing Price: 5.30 AUD, Target Price: 5.70 AUD, Recommendation: Buy.

We attended a group meeting with the board, our 3 key takeaways being:

§ Conservatism on capital allocation

§ Confidence in the long-term production plan

§ Open to growth options at a reasonable price.

Nufarm – FY18 result 4% below market; $303(¥33,330)m entitlement offer – Ticker: NUF.AX, Closing Price: 6.70 AUD, Target Price: 6.10 AUD, Recommendation: Sell. Valuation reduced 5% to $6.10(¥660)/share; Sell rating maintained – We believe there are still inherent earnings risks as evidenced by the greater skew to the second half (76% vs the expected 65-70%), the ongoing drought in Australia, the recent European acquisitions, higher raw material costs, volatility in Brazil and Argentina, US tariffs, and Brexit. With Sumitomo once again not taking up its entitlement in the $303(¥33,330)m equity raising, this could create a share overhang. We maintain our Sell rating with the stock trading at a 10% premium to our revised valuation of $6.10(¥660)/share and at 17.4x FY19e earnings.

Medibank Private – Market share wins can offset price cap – Ticker: MPL.AX, Closing Price: 2.92 AUD, Target Price: 3.40 AUD, Recommendation: Buy.

A 2% price cap is bad for PHI, but MPL can deal with the impact – In this note we look at the impact of a 2% price cap on our revenue assumptions for Medibank. We believe a 2% price growth cap for two years would have a negative impact on overall premium revenue for the industry. However, if MPL can continue its recent market share wins, and add 30k new customers a year for the next 3 years, on an existing customer base of 1.8 million policyholders, we believe it can offset the top line impact.

Orica Ltd Alert – Resignation of CFO – Ticker: ORI.AX, Closing Price: 17.15 AUD, Target Price: 17.00 AUD, Recommendation: Hold.

DB View – Vince Nicoletti is departing Orica for personal reasons and he will be replaced by Chris Davis from 1 October 2018. Chris joined Orica in 2013 and he has been the VP Group Finance since 2015. Prior to that, Chris was with Anglo American Group for 12 years, most recently as CEO of its subsidiary Scaw Metals Group. Vince Nicoletti was CFO for just 12 months. In 1H18, net operating cashflow was down 82% to $28.5(¥3,080)m with cash conversion declining to 37%. While we expect some improvement in the second half, we believe it will still be well below the company’s target level of 80%. The company reiterated its confidence in the outlook for FY18. We maintain our Hold rating on Orica with the stock trading at a 1% premium to our valuation of $17.00(¥1,870)/share and at 18.1x FY19e earnings.

Viva Energy Group – VEA liable for $31.2(¥3,410)m assessment – Ticker: VEA.AX, Closing Price: 2.34 AUD, Target Price: 2.65 AUD, Recommendation: Buy.

$31.2(¥3,410)m notice of assessment received from State Revenue Office of Victoria – Viva Energy Group announced today that it has been notified by Viva Energy REIT (VVR) of an assessment from the SRO for an amount of $31.2(¥3,410)m, relating to the transfer of properties shortly prior to the Viva Energy REIT IPO. Viva Energy Group is liable for this amount under the initial arrangements made between the Group and the REIT. Notably, the VEA prospectus commented that “Viva Energy remains liable to reimburse Viva Energy REIT for certain kinds of transaction costs that are incurred by Viva Energy REIT in connection with its establishment and ASX listing and which include stamp duty costs associated with the transfer of properties to Viva Energy REIT at that time”. The Group has stated that is does not agree with the SRO’s position and that it will lodge an objection to the Commissioner of State Revenue. In the case of an unfavourable outcome for the Group, the assessed amount will be recognised as a significant one-off item which will have an offsetting tax benefit due to a decrease in the initial capital gain recognised on the REIT’s IPO.

Morgans Research

Call to action – Westpac Banking Corp While WBC has announced increased provisions related to customer remediation and recent litigation, we view the magnitude of provisions as low compared to the extent of negativity baked into the share price. From our perspective, the main outstanding area of addressing customer issues for WBC now relates to its aligned financial planners. WBC remains our preferred major bank.

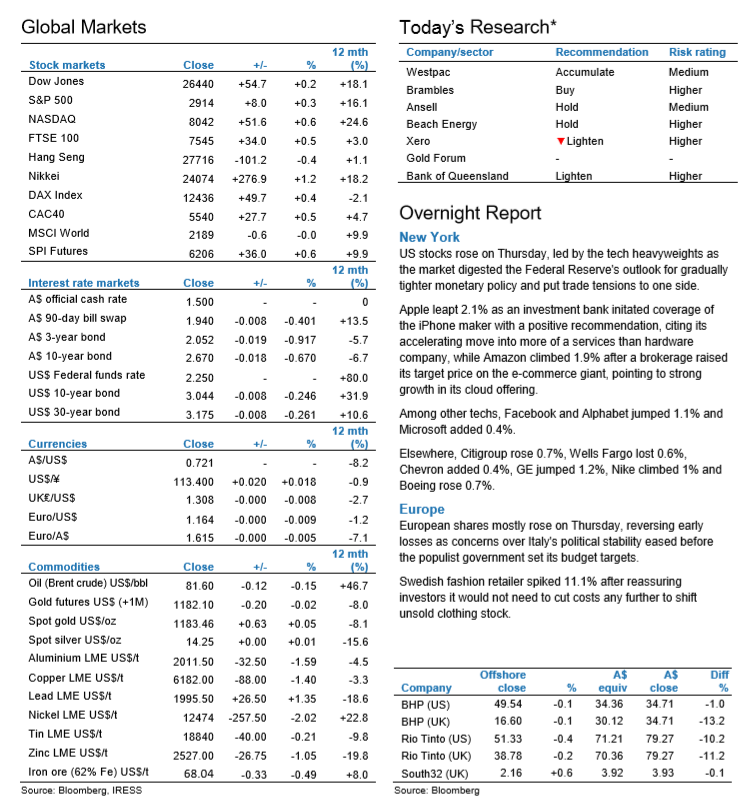

Overnight Highlights

US Market: US stocks rose, boosted by Apple and other FAANG shares as well as the Federal Reserve’s confidence in the strength of the economy. European Market: European shares rose slightly, reversing initial losses, as anxiety over political stability in Italy appeared to ease just hours before a cabinet meeting to set budget targets. Asian Market: Shares in Hong Kong closed lower after Hong Kong raised its base rate, prompting commercial banks to lift their benchmark rates for the first time in 12 years, and as new data showed slowing industrial profit growth in China.

Company Reports

Acrow Formwork (A$0.52(¥0)) ADD TP A$0.61(¥0) A closer look at Natform. In this note we take a closer look at the Natform acquisition and the potential opportunities that could arise for ACF in the long term. Natform has strong engineering capability and its screen systems complement ACF’s existing formwork and scaffolding rental offering. Although hard to quantify, the acquisition has the potential to deliver material revenue synergies over time. Despite strong share price appreciation over the past six months, ACF is still only trading on 8.7x FY19F PE and 3.7% yield. We therefore believe the stock remains an attractive investment proposition and maintain our Add rating.

Nufarm Limited (A$6.70(¥660)) HOLD TP A$6.85(¥660) FY18 – as bad as it gets In FY18, NUF experienced challenging seasonal conditions in most regions, a plant shutdown, a product ban and adverse FX. Drought and late seasons also severely impacted cashflow. To restore its balance sheet and to fund new growth initiatives, NUF has announced a A$303(¥33,330)m entitlement offer at A$5.85(¥550). FY19 guidance for 30-37% EBITDA growth was in line with expectations however it was highly qualified and earnings certainty is low at this point in the year. We move to a Hold rating given our new valuation is in line with the current share price however we recommend shareholders take up their entitlement offer.