Debt Restructure Planning – Make The Most Out Of Your Financial Future.

Here at Capri Financial Services, we know that many people face an uphill battle when it comes to finding a path to financial freedom. Millions of Australian families and individuals are working around the clock to try and pay off mortgages and loans that are keeping them locked into a life of debt, with very little light at the end of the tunnel. Little do people know how to best structure their debt to maximise the accumulation of assets while maintaining their disposable income. Its like paying for a gym membership but not getting into shape. Many people get into the property market to try and get ahead, but after a while, find they are not making the financial progress they first set out to achieve. Capri Financial Services is like your very own financial personal trainer. We can help you get on track, and stay on track by structuring a financial plan, and keep you accountable to achieving the goals you set out to, and ensuring you stay committed to maximising your financial future.

Having enough disposable income to live the life you enjoy is important to everyone. And just because you want to take that next holiday, or want to buy that new car, doesn’t mean you cannot still be making progress in paying off your debt. If you have a principle place of residence that you are paying off, are you maximising your opportunity to reduce your debt while increasing your investment assets? Capri can advise on the strategies that help you:

• Maintain your disposable income

• Reduce the term of your loan to pay your house off faster

• Potential tax benefits from restructured loan structures

• Increase the purchase of other investment assets

• Stick to a budget that accounts for your lifestyle while still making progress on your financial future

• Increase revenue generating assets to help supplement retirement income.

• Teach you how to manage your finances and keep you accountable to your commitment.

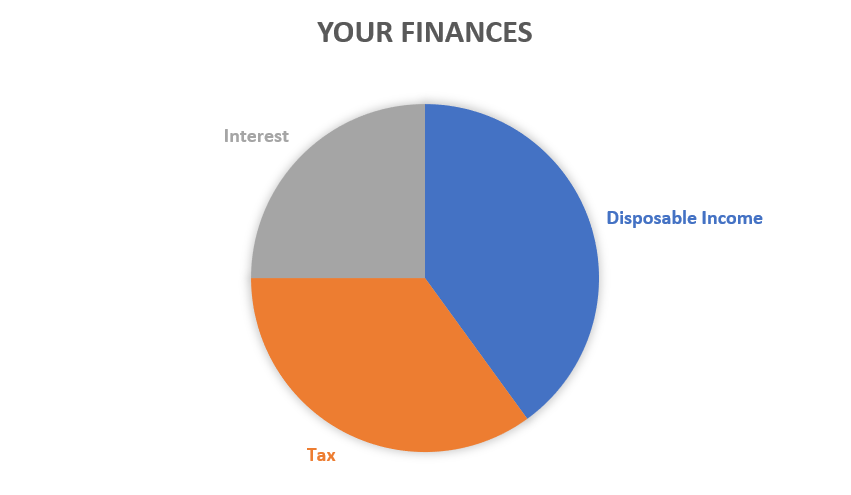

Your current strategy might look something like this:

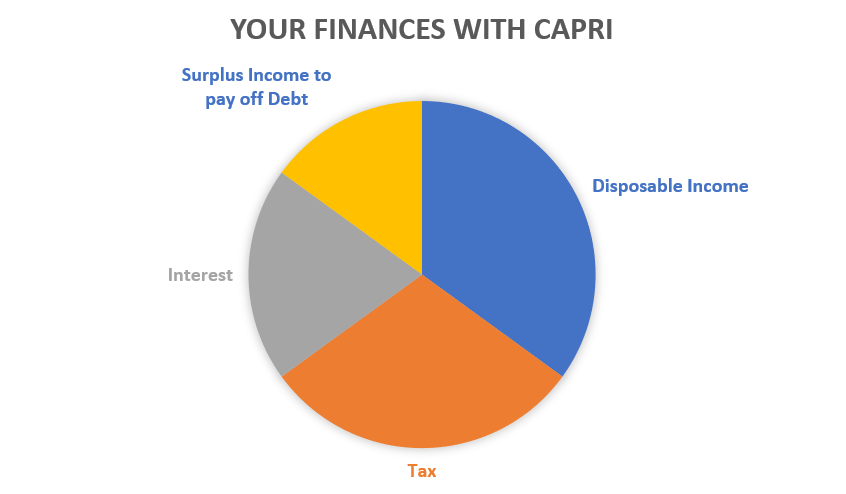

What Capri can help you achieve:

Capri’s experienced financial advisors can monitor your expenses to ensure your disposable income is maintained to continue to live the lifestyle to suit your budget. We can also guide you through the techniques required to reduce your debt, and create a surplus to increase your capacity to pay those debts off faster, while increasing your personal savings. Capri Financial Services will provide ongoing assistance and support and act as your financial personal trainer throughout the process, by developing the right action plan and holding you accountable to your budget and ensuring you stay on track. If you want to know more about what Capri can do for you, please contact our office for a free consultation.

Capri Financial Services

P: 07 5527 6040

E: info@caprifs.com.au