Ord Minnett Research

Deutsche Bank Research

Nufarm – Ticker: NUF.AX, Closing Price: 6.70 AUD, Target Price: 6.40 AUD, Recommendation: Sell. Sell rating and $6.40(¥660)/share valuation maintained. We expect Nufarm to report a soft full year result with underlying operating earnings down 16% on pcp and net earnings down 33% given the extended dry conditions in Australia and lower seed treatment sales in Europe. We expect net operating cashflow to be extremely weak and net debt to be well up on pcp. We also expect the company to flag weak Australian earnings in 1H19 and additional earnings risks in Europe. The company stated that it was reviewing the ANZ business for possible impairment and an equity raising cannot be ruled out. We maintain our Sell rating with the stock trading at a 5% discount to our valuation of $6.40(¥660)/share and at 16.7x FY19e earnings.

Regis Resources – Ticker: RRL.AX, Closing Price: 3.86 AUD, Target Price: 4.00 AUD, Recommendation: Hold. Regis looks locally for bolt-on pre-capex acquisitional growth. Regis has confirmed that it has been in discussions with Capricorn Metals Ltd (CMM.AX – Not Covered) and has put forward an indicative and incomplete proposal for 11.4 cents in Regis shares per Capricorn share. RRL has stated that before a binding offer can be announced, it requires the recommendation of the Board of Capricorn, the support of Capricorn’s major shareholder, and execution of a binding implementation statement. To date, Capricorn’s largest shareholder has not been prepared to support the Proposal and RRL expects to meet with them in the coming week to discuss. If support is not obtained before opening of the ASX on the 3rd of Oct, RRL reserves the right to terminate discussions. The implied valuation for CMM is c.A$85(¥9,350)m based on 748m shares and 10.8m options (there are 45m unlisted options with strike prices from 20-97cps). Our A$4.00(¥440)/sh PT is set in line with our NPV-derived valuation. We take a conservative approach to RRL, as much of the industry cost out has run its course, RRL must develop new satellite pits and the Rosemont UG mine to keep its mills full and lift grades. Maintain HOLD (0.97x P/NPV).

Brickworks Limited – Ticker: BKW.AX, Closing Price: 16.22 AUD, Target Price: 18.40 AUD, Recommendation: Buy. FY18 NPAT ahead of DB expectations; housing outlook the concern. Brickworks’ FY18 Underlying NPAT of $224(¥24,640)m was ahead of DB and consensus expectations due to better than expected Property earnings (largely $24(¥2,640)m in revaluation EBIT). While no FY19 NPAT guidance was provided, management outlined: 1) Building Products – residential activity is likely to decline in major east coast markets (impact softened by a strong order book) with energy prices to significantly impact earnings; 2) Land and Development – solid contribution from Property; 3) Investment – steadily increasing earnings and dividends expected over the long term. We retain our Buy recommendation with ~13% upside potential from the current share price.

James Hardie Industries – Ticker: JHX.AX, Closing Price: 20.91 AUD, Target Price: 23.60 AUD, Recommendation: Buy. 35/90 remains the destination, ColourPlus the vehicle. Pleasingly the incoming CEO (Jack Truong) reiterated the key growth ambitions of James Hardie including: 1) the 35/90 target (fibre cement to represent 35% of the US wood-look siding market and James Hardie to occupy 90% fibre cement market share); 2) the 20-25% US fibre cement EBIT margin target range; 3) 6% pa USA Primary Demand growth (albeit a minor reduction from the 6-8% range previously). While JHX has made a slow and steady return to PDG thus far, we expect it to consistently achieve 6% PDG (a slight reduction from ~7%, peak previously) by FY21 with early C+ pilot markets showing promising results. Buy retained.

Sonic Healthcare – Ticker: SHL.AX, Closing Price: 25.24 AUD, Target Price: 28.10 AUD, Recommendation: Buy. Court decision is a negative for SHL. The US District Court for the District of Columbia (“District Court”) has dismissed the American Clinical Laboratory Association’s (“ACLA”) lawsuit to halt implementation of cuts to reimbursement for lab testing. Our SHL forecasts do not assume a revision to the lab testing funding cuts. However we consider today’s District Court decision a negative for SHL because it is a setback to any potential revisions to funding cuts, or at the least it delays any possible improvement in funding.

Morgans Research

Overnight Highlights

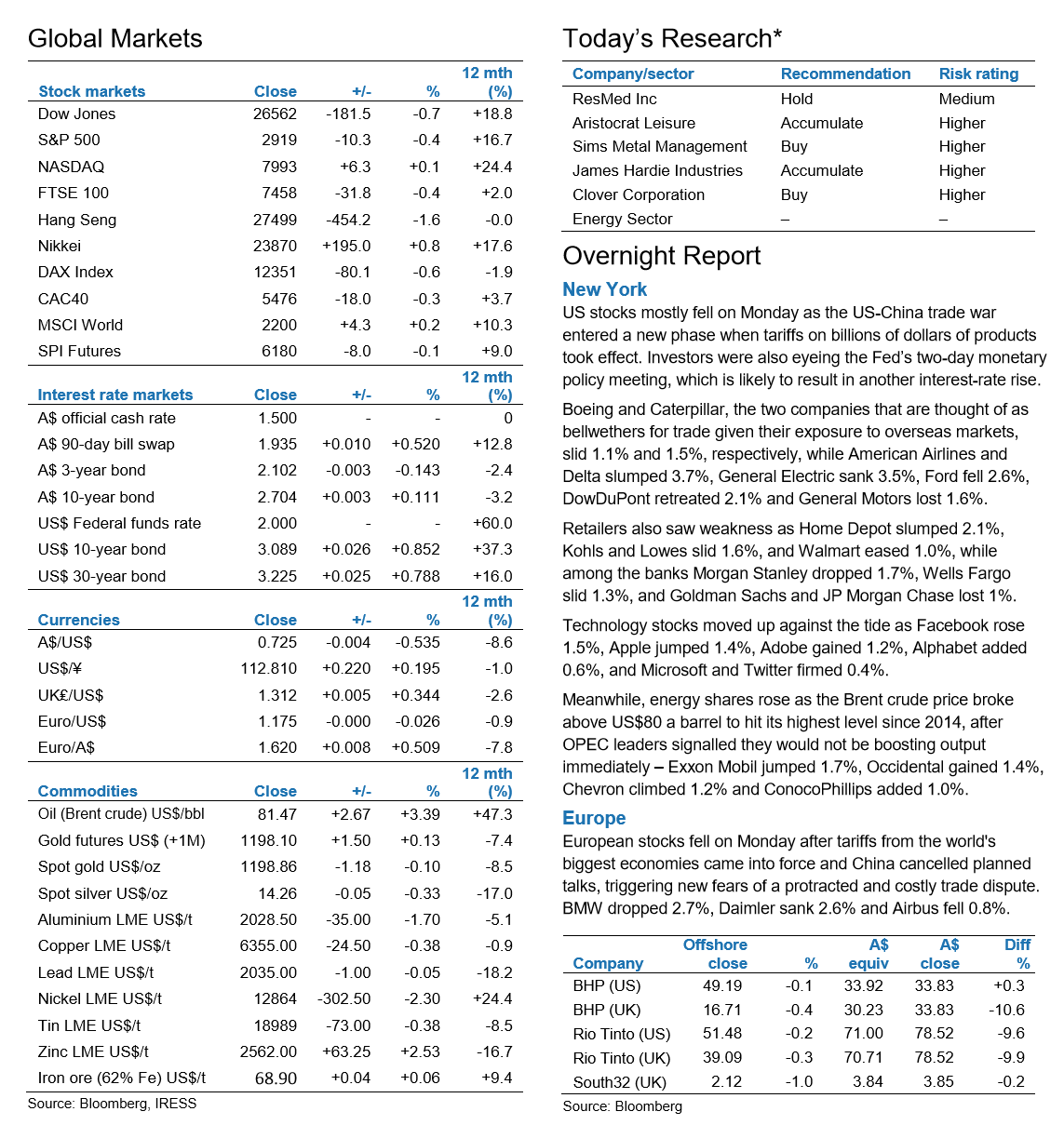

US Market: Industrials took the biggest knock on Wall Street on Monday as the latest US-China tariffs kicked in, while adding to uncertainty were questions over whether Deputy Attorney General Rod Rosenstein, who oversees the Mueller investigation, had quit. European Market: The US-China trade war dented European stocks on Monday after tariffs from the world’s biggest economies came into force and China cancelled planned talks, triggering new fears of a protracted, costly trade dispute. Asian Market: Stock indexes across Asia-Pacific declined, though markets in China, Japan and South Korea were closed for public holidays.

Company Reports

Technically Speaking – US Dollar Index, EURUSD, Copper, OZL, FDM US Dollar Index (DXY) – Heading lower. EUR/USD – Bullish bias strengthens. Copper – Bullish breakout. OZ Minerals (OZL) – Lifting our target. Freedom Oil and Gas (FDM) – First target reached.